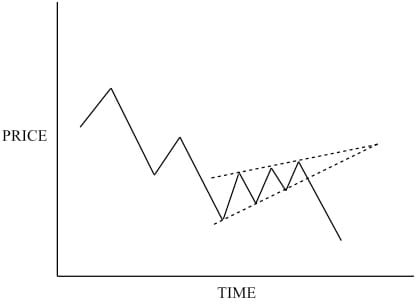

Therefore, one of the most common chart patterns in Forex, and not only, are triangles. Such an approach means that the trader focuses more on price action and what the pattern shows, rather than particularities of a specific market.Īll markets, regardless of type, have one thing in common. When trading with chart patterns, it is said that the trader has a pattern recognition approach. Mostly documented in the Western world, in the United States, they stood the test of time as reliable formations to predict future prices. Triangles – The Most Powerful Chart Patterns in ForexĬhart patterns belong to classic technical analysis. However, I’ll focus on some particularities that you might find useful. Some of the chart patterns presented here you have already probably heard of. More precisely, things you probably don’t know about chart patterns in Forex trading. However, instead of merely presenting them, I aim at disclosing unusual tips when trading with chart patterns. Some of them you have probably already read in my other article on chart patterns HERE. The aim here is to discuss the most relevant chart patterns in Forex. Therefore, chart patterns sit at the core of technical analysis, and they represent the basis of this article. Technical analysis without charts is not possible. In other words, technical analysis coupled with money management and discipline works even when regulators intervene. Yet, a quick look at that pattern reveals a descending triangle on the bigger timeframes. Everyone knew the central bank was on the other side of the trade for years. For instance, in January 2015 the SNB – Swiss National Bank dropped the peg on the EURCHF 1.20 floor.Īfter years of holding the level, the SNB dropped it suddenly. Market interventions are believed to alter patterns on the bigger timeframes more rarely. Namely, by sticking to the patterns and applying money management rules, nothing else happens but being stopped out. Yet, plenty of examples exist that even under such circumstances, the technical trader has an advantage. After all, central banksintervene from time to time to support a currency.

When regulators intervene, technical analysis might not work anymore. That is, technical analysis works on freely traded markets. However, there’s an imperative condition in place. The beauty of technical analysis is that traders use it on any market. Trading with Chart Patterns in Forex – What Every Trader Must Know This helps traders interpret the data through reading chart patterns. Because a chart records every price level through time. Instead, we talk about “traces” the market leaves behind. Here, we don’t talk about trading theories. Trading with chart patterns is an essential component of every technical analyst. However, the illogical, irrational part of human nature drives us to different paths in life. Your rational side of you knew that this is not why you got into that respective trade. Think of the last time you closed a trade before the price reached your target. After all, it doesn’t make sense to think that trading is the only exception where humans behave rationally. Triangles – The Most Powerful Chart Patterns in Forexīecause human nature plays tricks on us all, practitioners of technical analysis believe that this characteristic exists in markets too.Trading with Chart Patterns in Forex – What Every Trader Must Know.

0 kommentar(er)

0 kommentar(er)